The year is 2025. The world hungers for shiny loot. Geopolitical instability have sparked a new era of opportunism. A fresh Gold Rush is on the horizon, driven by an insatiable demand for valuables. Adventurers flock to new frontiers, armed with the latest technology. The race is on to extract the next big strike.

- Dare you join the rush?

- How will thrive in this volatile landscape?

Unlocking Gold's Future: Insights for 2025

As analysts peer into the crystal ball of 2025, gold remains a beacon of stability in an increasingly volatile world. Technological advancements are poised to transform gold's role, revealing new opportunities.

From green energy to cutting-edge nanotechnology, gold's unique properties will continue in high request. Additionally, growing geopolitical instability is likely to drive investors toward the secure asset of gold.

However, navigating this evolving landscape requires a strategic approach. Key considerations for 2025 include:

* Understanding the impact of technological developments on gold's worth.

* Evolving investment approaches to incorporate the shifting global economy.

Charting the Gold Market in 2025

As we stride towards 2025, the global gold market presents a landscape of both challenges. Factors such as geopolitical pressures, central bank movements, and evolving investor sentiment will dictate the trajectory of gold prices. Informed investors must strategically evaluate these factors to maximize their potential.

- Diversification remains a fundamental element for mitigating risk in any investment portfolio.

- Fundamental analysis tools can provide valuable insights for pinpointing potential patterns in the gold market.

- Keeping informed about market developments is critical to making prudent investment choices.

Gold 2025 Trends, Challenges, and Opportunities

As we transition into the future, the gold market is poised for significant evolution. Experts predict a future shaped by dynamic forces, presenting both opportunities and possibilities. Driving factors shaping the check here gold market in 2025 include the surge in gold investment from emerging markets, rising cost of living, and technological advancements.

- Overcoming regulatory hurdles will be crucial for market stability in the gold sector.

- Sustainability issues are gaining increasing prominence, driving a shift towards responsible mining within the industry.

{Despite these challenges, the gold market presentsa wealth of opportunities for stakeholders. Early adopters will be able to harness new opportunities and thrive in the evolving gold landscape.

The Price of Gold in 2025: Predictions and Analysis

Predicting the price of gold in 2025 is a complex endeavor, influenced by a multitude of factors. Analysts are closely monitoring global economic trends, inflation, and market psychology to develop their projections. Some foresee a substantial increase in gold prices, fueled by rising global demand particularly from developing nations. Others argue that gold prices may experience modest gains, as hedging factors could dampen inflationary expectations.

- Elements such as central bank policies and investor confidence can also significantly impact the price of gold.

- Historical data provides some guidance, but it is important to note that the future outlook of gold prices is inherently uncertain.

- In conclusion, predicting the exact price of gold in 2025 remains a challenge. It is wise for investors to conduct thorough research before allocating their assets.

Allocating to Gold: A 2025 Perspective

As we look ahead to 2025, this global market remains uncertain. Within this complexity, gold remains a a traditional hedge against economic turmoil. Factors such as geopolitical tensions are likely to impact gold's performance in the forthcoming years.

The precious metal's intrinsic value makes it a desirable option for diversification. Additionally, increasing appetite from key sectors may enhance gold prices.

However, it's crucial to approach gold allocation with a strategic mindset. Thorough research is vital to create sound investment decisions.

Possible investment thesis for gold in 2025 suggests a bullish trend, driven by intertwined elements. Might result in higher prices. Conversely, regulatory changes could negatively impact gold's value.

Ultimately, the path of gold prices in 2025 remains uncertain. Investors should be prepared for volatility accordingly.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Jennifer Grey Then & Now!

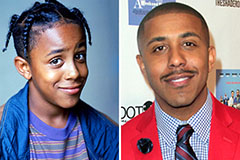

Jennifer Grey Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!